Is China blocked out of the plywood market?

In November 2025, the EU imposed anti-dumping duties of up to 86.8% on Chinese hardwood plywood. In January 2026, the US followed with duties of around 81%. On paper, these are very high trade barriers. The obvious question is what the real impact will be.

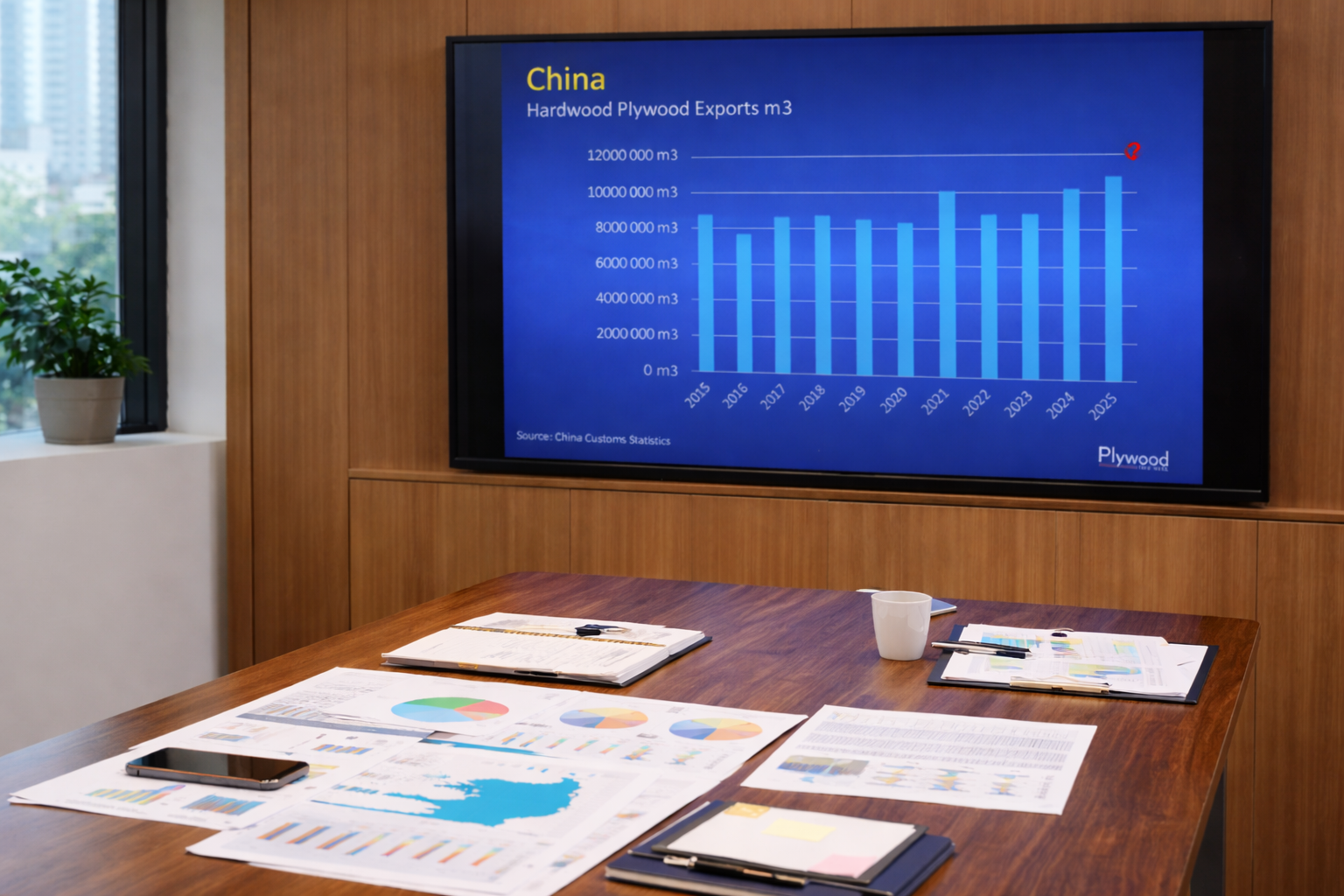

In 2025, China’s hardwood plywood exports remained broadly stable at around 10 million m³, unchanged from the previous year. Volumes did not grow, but they did not collapse either. This is notable.

In the US, imports of Chinese plywood have already been limited for years due to earlier trade conflicts, so the new duties mainly formalise an existing situation. In the EU, Chinese hardwood plywood has remained present, but an 86% duty effectively closes the market for normal trade. The UK stands out as an exception. Without anti-dumping duties on plywood, it remains open to Chinese supply.

In the second half of 2025, China’s five largest destinations for hardwood plywood were the Philippines, United Arab Emirates, the UK, Nigeria, and Saudi Arabia. Together, these markets imported close to 2 million m³ in just six months. This highlights that volumes are being redirected rather than eliminated.

China remains a central pillar of global goods trade. Both the EU and the US depend on Chinese supply chains far beyond plywood. In this context, plywood tariffs are significant for the plywood industry, but marginal in the wider trade relationship.

What stands out is caution rather than open conflict. Most governments appear careful not to push trade tensions too far with an important partner. For now, the EU and the US are largely closed to Chinese hardwood plywood. But “China speed” is real. New routes and structures will emerge, as already seen in Chinese involvement in Vietnamese plywood operations.

For the plywood market, the lesson is familiar: trade barriers tend to reshape flows more than they stop them. The flow changes shape, but it rarely stops.